Following the pandemic, there is an increase in inflationary pressures that affect every consumer, putting financial wellness at risk for households at all demographic levels. Financial institutions can help their customers by providing financial education, personalized recommendations, and even targeted relief.

The question is whether banks and credit unions will respond in a way that demonstrates an understanding of the customer, empathy for the difficulties being faced, and recognition of the potential for future loyalty. Unfortunately, the majority of financial institutions fall short of what is possible with today’s technology and insights.

Consumers Feeling Economic Stress

It’s not surprising that consumers’ expectations for future inflation are rising, given how rising prices affect their daily lives. The last time inflation in the United States was this high was in the early 1980s, which means that most Americans have never experienced high inflation or its consequences. This raises concerns about the appropriate financial and lifestyle responses.

Based on previous inflationary periods, consumers tend to buy essentials and durables such as appliances and furniture while becoming less likely to buy discretionary goods and services. Consumers also have a greater need for savings and emergency funds. The speed and rate of inflation usually influence the decision between spending and saving.

According to a Personetics survey of 5,000 consumers, 93 percent are concerned about the impact of rising prices and inflation on their daily lives. In response, more than half (61%) reduced their spending on non-essential items, with large percentages of consumers finding other ways to make ends meet, such as reducing home energy use (43%), eliminating restaurant meals (48%), cancelling large purchases (35%), and cancelling vacations/holidays (35%). (25 percent ).

In this period of economic uncertainty, it is important for banks and credit unions to realize, and respond to, the concerns of consumers around financial well-being that also impacts mental health, physical health, productivity and even social engagement.

Financial Institutions Slow to Assist

Financial wellness is defined by EY as “the ability to make confident, well-informed money-related decisions that result in financial security in both the short and long term.” Consumers want their financial institution to support their financial well-being in times of stress, assisting in giving them confidence in their ability to spend, save, and invest safely.

Customers expect more from their financial institution than chatbots and account updates. They anticipate proactive digital dialogue that offers solutions to improve financial security.

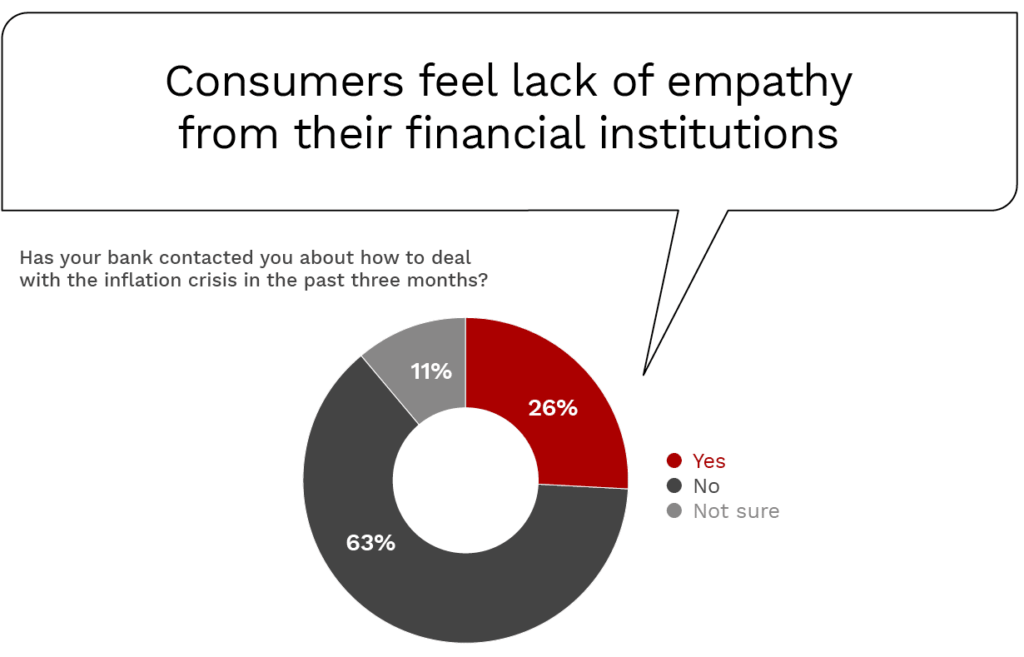

Unfortunately, respondents to the Personetics survey stated that their financial institutions are not doing enough to assist them. While more than half (51%) of respondents said they wanted more help from their bank with money management, only slightly more than a quarter (26%) said they had heard from their financial institution in the previous three months about the economy.

According to the study, even those who received some communication from their bank were dissatisfied with the generic advice they received (66 percent), with only 37 percent receiving personalised messages (less than 10 percent of the entire consumer marketplace).The result was that 21% felt their bank doesn’t understand their financial needs at this time, with 20% believing their bank doesn’t care about their problems

Consumers Demanding More From Their Bank

Customers expect their financial institution to know, understand, and reward them with solutions that meet their specific needs. When asked what they expected from their bank and credit union, the most common request (30 percent) was for advice on how to save more money each month and relief from fees incurred when their accounts were overdrawn (29 percent ). With the history of data and insights available to most financial institutions, both of these expectations are not difficult to deliver – on a personalised basis.

Consumers also want personalised recommendations for less expensive financial products such as credit cards or loans (26%) and reminders to cancel subscriptions they may have forgotten about (25 percent ).

Most importantly, customers expect their financial institution to be proactive in its recommendations and solutions for better financial management. According to Personetics, roughly two-thirds of people want their financial institution to automate financial decisions and money management to save them time, such as automatically transferring spare cash into a savings account (61 percent) and identifying early signs of financial stress and responding with solutions and advice (66 percent ).

The Payoff for Financial Institutions

The current economic environment offers financial institutions a once-in-a-lifetime opportunity to assist their customers throughout their entire customer lifecycle. The payoff for providing proactive, personalised advice and solutions, rather than waiting for a customer to act, has never been greater.

In a hotly contested competitive environment, financial institutions can retain current customers, grow relationships, and acquire new customers by leveraging their existing data and insights accumulated over years of transactions and behaviours.

According to the research, over half (58%) of banking customers would consider switching to an organization that offers better money management features. In particular, consumers want help growing their savings and assistance with their everyday budgeting and money allocation. Consumers also want financial insights delivered that are contextual and personalized.